Gamestop was the week’s top trending cybercrime target as the company is investigating reports that customer payment card information may have been stolen from gamestop.com. In addition to Gamestop, payment card information was also stolen from the restaurant chain Shoney’s and a series of car washes have issued breach notification letters tied to a compromise at an unnamed third-party point-of-sale (POS) provider.

Two sources told Brian Krebs last week that an alert from a credit card processor indicated gamestop.com was likely compromised by intruders between mid-September 2016 and the first week of February 2017. The sources said that card numbers, expiration dates, names, addresses, and verification codes were stolen due to the breach. Gamestop also operates thousands of retail locations, but there is no indication that those have been affected.

However, dozens of Shoney’s locations were impacted by a recent POS breach. A week after Krebs reported the Gamestop breach, confidential alerts from credit card associations stated that similar payment card data was stolen from the restaurant chain. Best American Hospitality Corp., which manages some of Shoney’s corporate affiliated restaurants, later issued a press release saying that remotely installed POS malware led to breaches at 37 Shoney’s locations between December 27, 2016, and March 6, 2017.

In addition, Acme Car Wash, Auto Pride Car Wash, Clearwater Express Car Wash, Waterworks Car Wash, and Wildwater Express Carwash were all notified of a point-of-sale (PoS) malware infection by their unnamed third-party POS provider. The notification occurred on March 27, and customers who used a payment card at those business during various periods in February may have had their data compromised.

Other trending cybercrime events from the week include:

- New data breaches announced: A backup database containing information on 918,000 people and belonging to telemarketing company HealthNow Networks was exposed on the Internet, compromising a variety of individuals’ personal and health information. The payday loan company Wonga is investigating a data breach that may have affected up to 245,000 customers in the UK and 25,000 customers in Poland. As many as 115 families had their private information compromised when the Victorian Education Department mistakenly published documents to its website for 24 hours. At least 83 University of Louisville employees had their W-2 forms accessed when an intruder gained access to W-2 Express, a product of Equifax used by the school to provide employees with access to tax documents.

- More SWIFT attacks made public: The Union Bank of India faced an attack leveraging the SWIFT system that attempted to perform $170 million in fraudulent transactions last July, but the bank was able to block the transfer of funds, the Wall Street Journal reported. The bank’s SWIFT access codes were stolen by malware after an employee opened a malicious email attachment, and the codes were used to send fraudulent instructions in an attack similar to the one that successfully stole $81 million from the Bangladesh central bank’s account at the New York Federal Reserve in February 2016.

- Ransomware continues to impact patient care: A ransomware infection at Erie County Medical Center blocked access to electronic patient records and forced the center to reschedule some elective surgeries, sources told news outlets; however, the hospital has yet to confirm the shutdown of its computer was due to ransomware. IT workers have been re-imaging about 6,000 desktop computers that had to be wiped clean as a result of the infection. Ashland Women’s Health reported a data breach affecting 19,727 patients after ransomware encrypted data on the practice’s electronic health record system, including its patient scheduling application. The practice was able to restore the encrypted data using a backup, and patient care was impacted for a couple of days due to the incident.

- Amazon seller accounts being hacked: Hackers are using previously compromised credentials to hijack the accounts of third-party sellers on Amazon Marketplace, change the bank account information, and then post nonexistent merchandise at cheap prices to defraud customers. The buyers are eligible for refunds from the sellers, which may come as a surprise to the account owners as the hackers are targeting dormant accounts. A company spokesperson told NBC News that it is working to make sure sellers do not have to handle the financial burden of the hacks.

- Other notable cybercrime events: Five inmates at the Marion Correctional Institution used computers built from spare parts and hidden in a ceiling in a closet to perform a variety of malicious activities while incarcerated. A team of Indonesian hackers gained access to the online ticketing site Tiket.com and stole approximately Rp 4.1 billion ($308,000 USD) worth of airline tickets from carrier Citilink. Dallas officials are blaming a hacker for setting off all 156 of the city’s warning sirens more than a dozen times.

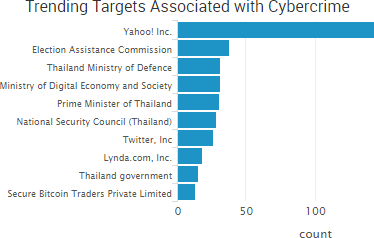

SurfWatch Labs collected data on many different companies tied to cybercrime over the past week. Some of those “newly seen” targets, meaning they either appeared in SurfWatch Labs’ data for the first time or else reappeared after being absent for several weeks, are shown in the chart below.

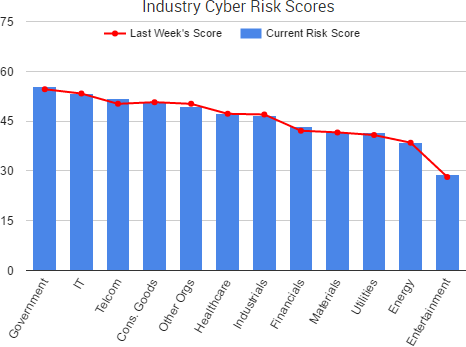

Cyber Risk Trends From the Past Week

A variety of stories from the past week once again highlighted threats that originate not from external hackers, but from organizations’ employees and poor risk management practices.

A variety of stories from the past week once again highlighted threats that originate not from external hackers, but from organizations’ employees and poor risk management practices.

To start, Allegro Microsystems has accused a former employee of causing $100,000 worth of damages by logging into the company’s network multiple times after resigning in order to implant malware. According to court documents, the man allegedly returned a computer meant for personal use rather than his work computer when resigning, and he used that work computer along with system administrator credentials to insert malicious code into Allegro’s finance module. The employee “designed the malicious code to copy certain headers or pointers to data into a separate database table and then to purge those headers from the finance module, thereby rendering the data in the module worthless,” the documents stated.

Another case involved a DuPont employee who admitted to stealing data from DuPont in the months before he retired in order to bolster a consulting business he planned to run. The man allegedly copied 20,000 files to his personal computer, including formulas, data, and customer information related to developments in flexographic printing plate technology. He also took pictures of restricted areas of DuPont’s plant.

On the regulatory side, the FDA sent a letter to St. Jude Medical demanding the company take action to correct a series of violations related to risks posed by the company’s implantable medical devices — an issue that received quite a bit of attention last summer after a report published by Muddy Waters and MedSec shed light on the alleged vulnerabilities. St. Jude must respond to the FDA within 15 days with “specific steps [it has] taken to correct the noted violations, as well as an explanation of how [it] plans to prevent these violations, or similar violations, from occurring again” — or else St. Jude may face further regulatory action, including potential fines.

That is what happened to Metro Community Provider Network (MCPN), which agreed last week to pay $400,000 following a January 2012 phishing incident that exposed the electronic protected health information (ePHI) of 3,2000 individuals. An investigation conducted by the Office for Civil Rights revealed that “prior to the breach incident, MCPN had not conducted a risk analysis to assess the risks and vulnerabilities in its ePHI environment, and, consequently, had not implemented any corresponding risk management plans to address the risks and vulnerabilities identified in a risk analysis.” As a result, MCPN will pay the penalty and implement a corrective action plan to better safeguard ePHI in the future.

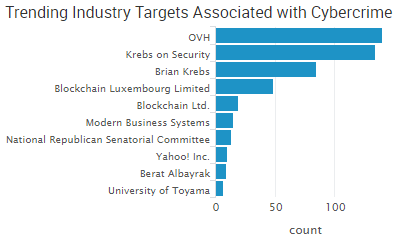

Looking beyond the ongoing Yahoo story, there were several unique cybercrime-related events worth noting from the past week.

Looking beyond the ongoing Yahoo story, there were several unique cybercrime-related events worth noting from the past week.

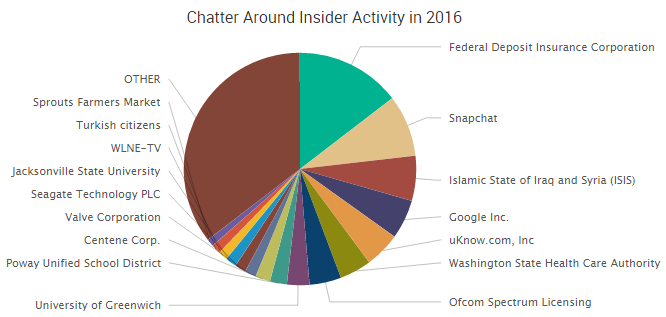

Several stories from the past week once again highlighted the problem of malicious insiders stealing intellectual property and taking that stolen data directly to company rivals in order to give those rivals a leg up on the competition.

Several stories from the past week once again highlighted the problem of malicious insiders stealing intellectual property and taking that stolen data directly to company rivals in order to give those rivals a leg up on the competition.

It was also recently announced that

It was also recently announced that