The week’s top cybercrime event was the spread of WannaCrypt ransomware, which managed to infect tens of thousands of computers on Friday. The attack affected NHS hospitals and facilities in England and Scotland, Telefonica and Gas Natural in Spain, FedEx in the U.S., and numerous other organizations — largely across Asia and Europe.

By Saturday researchers reported more than 126,000 detections of the ransomware across 104 countries. The number of infections may have been worse, but the security researcher MalwareTech managed to halt the spread of the malware by purchasing a domain name, which essentially triggered a “kill switch.” MalwareTech explained why the ransomware had this design:

By Saturday researchers reported more than 126,000 detections of the ransomware across 104 countries. The number of infections may have been worse, but the security researcher MalwareTech managed to halt the spread of the malware by purchasing a domain name, which essentially triggered a “kill switch.” MalwareTech explained why the ransomware had this design:

“I believe [the attackers] were trying to query an intentionally unregistered domain which would appear registered in certain sandbox environments, then once they see the domain responding, they know they’re in a sandbox [and] the malware exits to prevent further analysis. This technique isn’t unprecedented and is actually used by the Necurs trojan … however, because WannaCrypt used a single hardcoded domain, my [registration] of it caused all infections globally to believe they were inside a sandbox and exit.”

WannaCrypt leverages an allegedly NSA-derived exploit called “EternalBlue” that was made public by TheShadowBrokers last month. Microsoft has patched the flaw (MS17-010), but Friday’s events made it clear that many organizations have yet to apply that patch. Microsoft also announced that it is taking “the highly unusual step” of providing a security update for Windows XP, Windows 8, and Windows Server 2003 to help protect its customers from the threat. Organizations should patch immediately. As MalwareTech noted on Sunday, the last version of WannaCrypt was stoppable, but the next version will likely remove that flaw.

Other trending cybercrime events from the week include:

- Third-party providers lead to breaches: Hackers managed to gain access to the stem files of Lady Gaga last December by sending spear phishing messages to executives at September Management, a music management business, and Cherrytree Music Company, a management and record company. Debenhams Flowers said that 26,000 website customers had their data compromised due to malware stealing their payment details from Ecomnova, a third-party e-commerce company. The email addresses and usernames of individuals who used the dating website Guardian Soulmates were exposed by a third-party service provider, resulting in members of the site receiving explicit spam emails.

- Malicious actors sell and leak stolen data: A dark web vendor using the handle “nclay” claims to have 77 million records stolen from social learning platform Edmodo and is attempting to sell them on the dark web for just over $1000. The data allegedly includes usernames, email addresses, and passwords that are hashed with bcrypt and salted. Malicious actors leaked 9GB of internal documents from the campaign staff of France’s President-elect Emmanuel Macron in the days prior to the country’s election. A group known as “TuftsLeaks” published financial information belonging to Tufts University, including department budgets, the salaries of thousands of staff and faculty, and the ID numbers of student employees.

- Healthcare organizations expose data: Patients of Bronx-Lebanon Hospital Center had their sensitive health and personal information exposed to the internet due to a misconfigured rsync backup managed by IHealth Innovations. The records and files from a number of departments were publicly accessible and viewable, including cardiology, surgery, pulmonology, psychiatry, and neurosurgery. A flaw in the website of True Health Diagnostics allowed users to view the medical records of other patients by modifying a single digit in the PDF link to their own records. Diamond Institute for Infertility and Menopause in New Jersey said that 14,633 patients had their data exposed due to an unknown individual gaining access to the third-party server in February 2017.

- Other notable cybercrime news: An internet-connected backup drive used by New York University’s Institute for Mathematics and Advanced Supercomputing contained hundreds of pages of documents detailing an advanced code-breaking machine that had never before been described in public. The project was a joint supercomputing initiative administered by NYU, the Department of Defense, and IBM. A California court has found a former private security officer guilty of hacking into the servers of Security Specialists, his former employer, to steal data on customers; delete information such as archived emails, server files, and databases; deface the company website; steal proprietary software; and set up a rival business that used the stolen software. The incident occurred after the employee was fired in 2014 for logging into the payroll database with administrative credentials in order to pad his hours. Confluence Charter Schools is warning parents and staff that a hack of network servers has impacted email, phones, SISFIN, its financial system, and its student information system Infinite Campus and that the “breach has caused some files to be unrecoverable.”

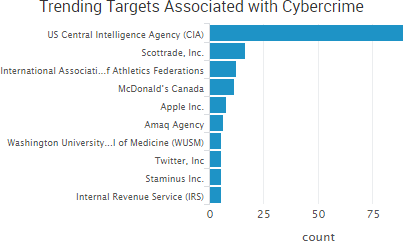

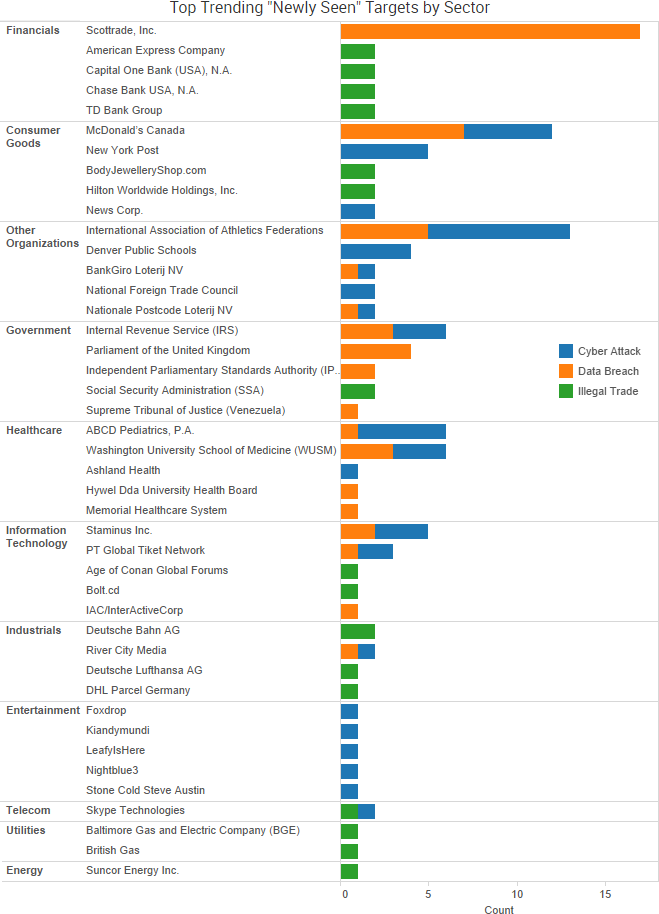

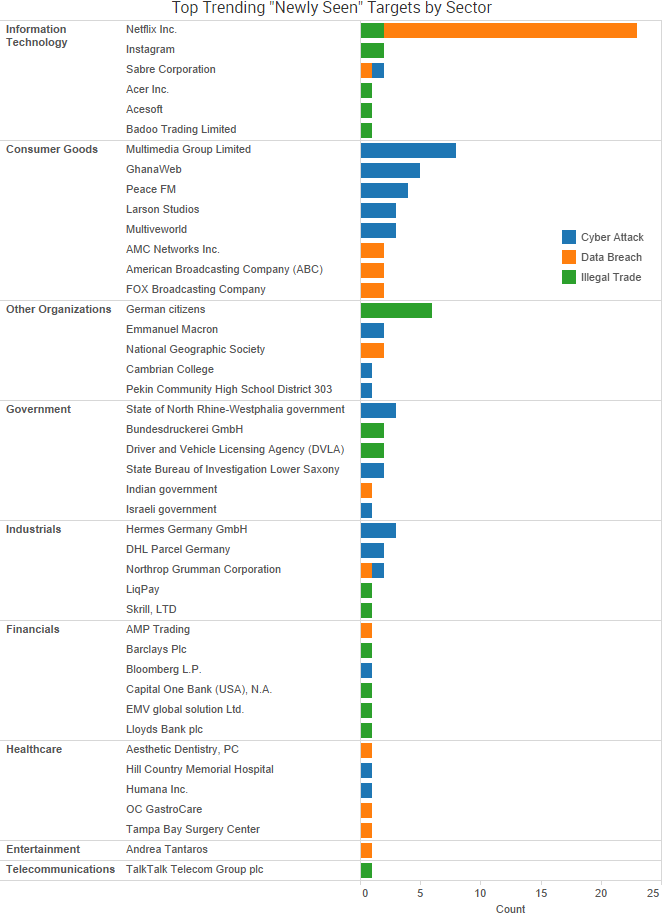

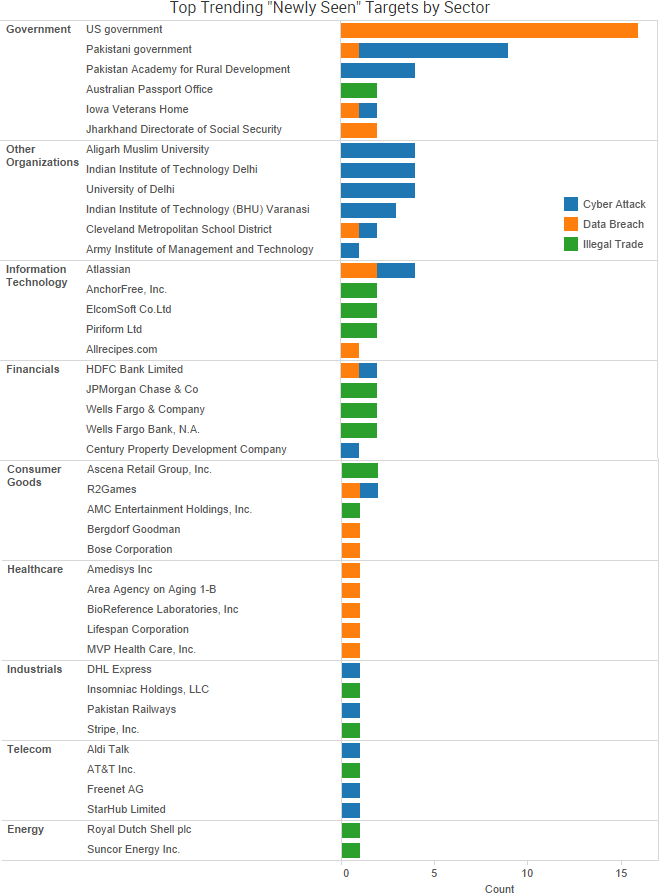

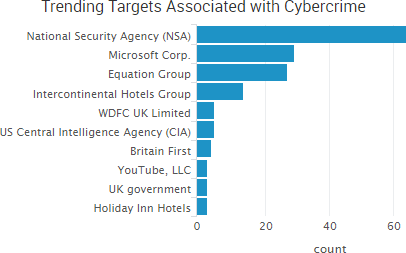

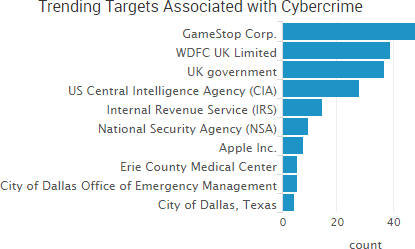

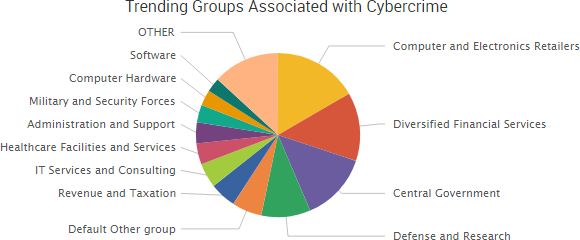

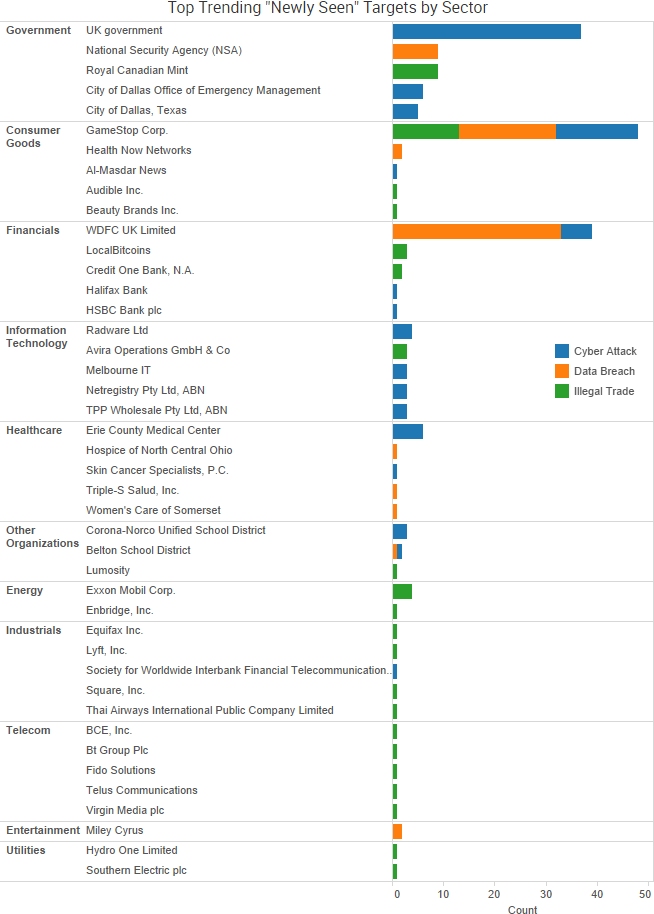

SurfWatch Labs collected data on many different companies tied to cybercrime over the past week. Some of those “newly seen” targets, meaning they either appeared in SurfWatch Labs’ data for the first time or else reappeared after being absent for several weeks, are shown in the chart below.

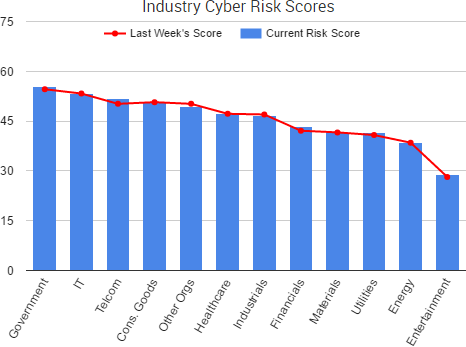

Cyber Risk Trends From the Past Week

On Thursday, President Donald Trump issued an executive order on strengthening the cybersecurity of federal networks and critical infrastructure. The order includes a variety of mostly reporting requirements designed to protect federal networks, update outdated systems, and direct agency heads to work together “so that we view our federal I.T. as one enterprise network,” said Trump’s homeland security advisor Tom Bossert.

On Thursday, President Donald Trump issued an executive order on strengthening the cybersecurity of federal networks and critical infrastructure. The order includes a variety of mostly reporting requirements designed to protect federal networks, update outdated systems, and direct agency heads to work together “so that we view our federal I.T. as one enterprise network,” said Trump’s homeland security advisor Tom Bossert.

The order also requires the heads of federal agencies to use The Framework for Improving Critical Infrastructure Cybersecurity developed by the National Institute of Standards and Technology (NIST) to assess and manage their agency’s cyber risk. Each agency must submit a risk management report to the Secretary of Homeland Security and the Director of the Office of Management and Budget (OMB) within 90 days that outlines their plan to implement the framework. The director of OMB and other supporting officials will then have 60 days to review the reports and pass along information to the president regarding a plan to align budgetary needs, policies, guidelines, and standards with the NIST framework. The Obama administration had previously encouraged the private sector to adopt the NIST framework, but government agencies were never required to follow it — until now.

“It is something that we have asked the private sector to implement, and not forced upon ourselves,” Bossert said at the daily White House press briefing on Thursday. “From this point forward, departments and agencies shall practice what we preach and implement that same NIST framework for risk management and risk reduction.”

The order also includes reporting regarding critical infrastructure, which builds upon the order issued by Obama in 2013, and reporting on “strategic options for deterring adversaries and better protecting the American people from cyber threats.”

As many media outlets have reported, the executive order has received a mostly positive response from the cybersecurity community; however, it is largely a continuation of the cybersecurity policy under previous administrations and has received some criticism for being more focused on reporting than actions.

Several recent cybercrime events have proven that although two-factor authentication is an effective way to prevent fraudulent transactions, malicious actors are focusing their efforts on ways to defeat that increasingly popular layer of security.

Several recent cybercrime events have proven that although two-factor authentication is an effective way to prevent fraudulent transactions, malicious actors are focusing their efforts on ways to defeat that increasingly popular layer of security.

Facebook and Google confirmed this week that they were the victims of the $100 million phishing scheme announced by the Department of Justice of

Facebook and Google confirmed this week that they were the victims of the $100 million phishing scheme announced by the Department of Justice of

According to the company’s

According to the company’s

A variety of stories from the past week once again highlighted threats that originate not from external hackers, but from organizations’ employees and poor risk management practices.

A variety of stories from the past week once again highlighted threats that originate not from external hackers, but from organizations’ employees and poor risk management practices.